The Expensive Reality of ADS-B In for Airlines

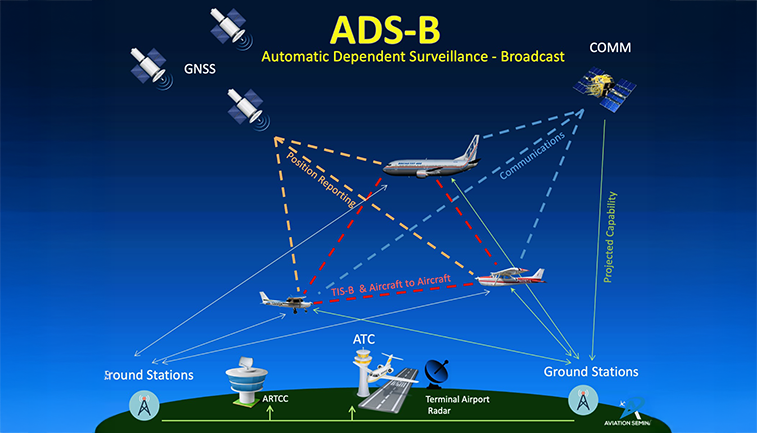

For more than a decade, regulators have hailed Automatic Dependent Surveillance–Broadcast (ADS-B) In as the next step in airspace efficiency, promising richer situational awareness, tighter traffic spacing, and faster responses in congested skies. Pilots and air traffic controllers have long nodded along to the theory. However, in airline operations rooms,…

Read more